If you’ve decided to become an independent owner operator, your next big decision will be whether to lease or buy your truck. There are pros and cons to each, of course, so it’s important to set your personal parameters first.

Know how much, if anything, you have available to put as a down payment, and have a vision for what you want your long-term finances to look like. Be aware that those just starting off on their own are not likely to hit the “average” salary for an owner operator, so make sure you have a realistic expectation for your beginning years of income. Work in whether you are using factoring or other options to improve your cash flow.

Now let’s get down to it.

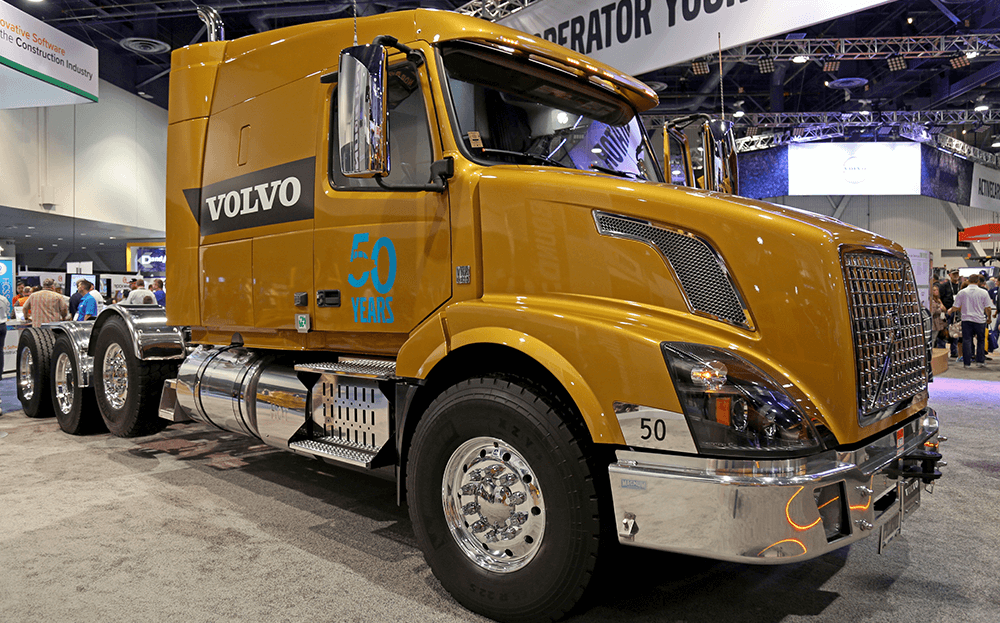

Purchasing a Big Rig

From a purely financial perspective, purchasing your own truck is typically the best way to go. When you purchase a truck, you build equity with each month’s payment, just as you would when mortgaging a home. When your payments are completed, you own the truck outright—you can either continue to drive it payment-free or use the equity in it to trade in for a new rig whenever you choose.

On the downside, purchasing usually requires a down payment of about 10 percent of the purchase price for a new truck and 20 to 25 percent for a used rig. Some lenders even require a letter from your carrier showing you will be employed at a certain wage for the duration of your purchase agreement.

When you purchase your truck, you’ll have lower insurance premiums than if you leased. There may also be tax advantages for those owning their own trucking business if they know how to play their cards right.

Keep in mind that most purchasing agreements include a three to five year loan, so make sure you’re committed.

Leasing a Big Rig

You can think of leasing a truck like renting an apartment. You do not build equity with your payments, and you do not own the truck at the end of your lease term. You do, however, usually have a buy-out price at the end for which you can purchase the truck outright. This buy-out option is typically a large lump sum payment that is predetermined when you sign your lease agreement.

When you get involved in a big rig lease, you agree to certain rules and regulations to keep the truck in good condition when you turn it back in. Some conditions may restrict your mileage—just like a personal vehicle, if you go over your allotted mileage, you pay a predetermined cost per mile.

On the plus side, the lessor will cover many maintenance costs. After all, they want that truck back in good condition since they own it.

The main benefit of leasing is the short-term savings. You usually pay less upfront (little to no down payment) and your monthly installments will be less than a purchase agreement. Some drivers also prefer the flexibility of turning the truck in and getting a new one, particularly if they are new to the industry and want to experiment. However, if you plan to drive for more than three years and have the cash for a down payment, purchasing will save you thousands in the long run.

Leasing agreements, like purchases, are also three to five years; however, you can usually back out of a leasing agreement before your time is up. You will just pay a lump sum penalty for breaking the lease. Beginners tend to go with leasing in case their plans do not work out for a full three years. Be sure to read the fine print of your lease. Set money aside in case you need to pay the penalty for breaking it.

How Much Does a Big Rig Cost?

To buy a semi truck, you’re typically looking at around $100,000, but the final cost can range from $70,000 to $175,000. Used semi truck sales can start as low as $15,000 for a bare bones cab and run up to $100,00 for higher end models.